bir form 2305 online registration|2302 Bir Form : Tagatay Requirements | What you Need to Get. A photocopy of your PSA marriage certificate; A photocopy of any valid ID; Two (2) copies of BIR Form 1905 for self-employed individuals, and BIR Form 2305 for . 10 Best Online Casinos for Real Money USA [Sep 2024] 10 Best PayPal Online Casinos in 2024; 10 New Online Casinos that Pay Real Money [Sep 2024] About Us; Best 10 Online Casino Bonuses [2024] Best Free Casino Games Online in 2024: Play & Win Now; Best Online Casino Reviews for 2024; Best Online Casinos Australia for Real Money [2024]

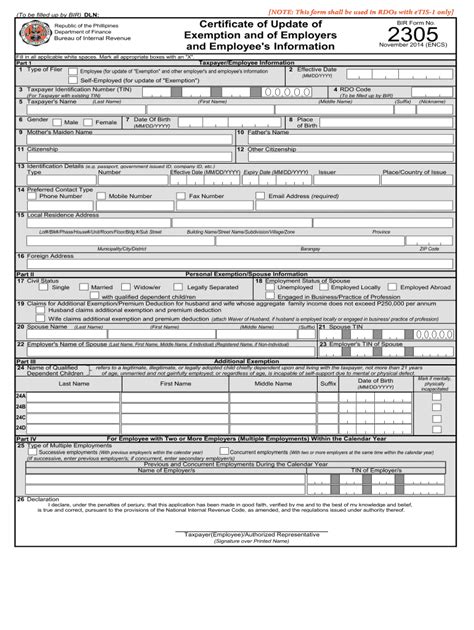

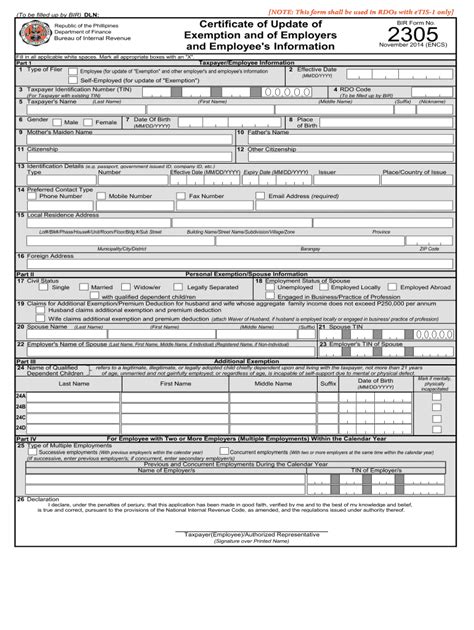

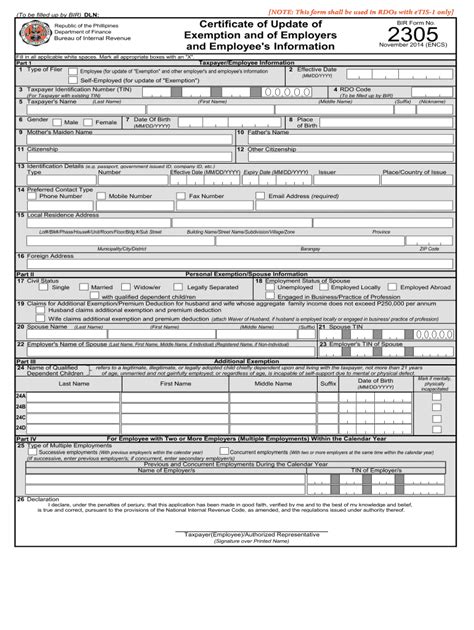

bir form 2305 online registration,BIR Form No. 2305 Certificate of Update of Exemption and of Employer's and Employee's Information. A BIR Certificate to be accomplished and issued in case of increase or .This document is a Certificate of Update of Exemption and Employer's and Employee's Information form submitted to the Bureau of Internal Revenue (BIR). It contains .bir form 2305 online registration 2302 Bir Form This document is a Certificate of Update of Exemption and of Employer's and Employee's Information form from the Bureau of Internal Revenue of the Philippines. It collects information to update a taxpayer's personal . Requirements | What you Need to Get. A photocopy of your PSA marriage certificate; A photocopy of any valid ID; Two (2) copies of BIR Form 1905 for self-employed individuals, and BIR Form 2305 for .

This document is a Certificate of Update of Exemption and Employer's and Employee's Information form submitted to the Bureau of Internal Revenue of the Philippines. It collects personal information about the .01. Edit your bir 2305 online. Type text, add images, blackout confidential details, add comments, highlights and more. 02. Sign it in a few clicks. Draw your signature, type it, upload its image, or use your mobile device as a .

BIR Form No. 2305 Certificate of Update of Exemption and of Employer's and Employee's Information.

BIR eAppointment System. BIR office to book an appointment: Revenue District Office No. 21B - South Pampanga. Select the service that you want to avail of: Assessment .BIR 2305 Form is used to update your Employer Information and Tax Status. You must fill-out the following items: o 1 – Type of Filler; Mark the Employee boxBIR Form 2305, also known as the Certificate of Update of Exemption and of Employer's and Employee's Information, is a document used in the Philippines by employees and employers to update each other's .

Prior to the issuance of RMO No. 37-2019, employees who recently changed employers update their BIR registration records through their new employer by filing a Certificate of Update of Exemption and of .The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR .Prepare an accurate Bir Form 2305 in your browser. Get started quickly using our free form templates and drag-and-drop form builder. Bir Form 2305. Home; . This form is used when an employee receives . IN line with Republic Act (RA) 10754, also known as “An Act Expanding the Benefits and Privileges of Persons with Disability (PWD),” and Revenue Regulations 5-2017, the Bureau of Internal Revenue (BIR) has updated the Certificate of update of exemption, and employer and employee’s information (BIR Form 2305) and the .With our PDF editing tool, you can acquire the bir form 2305 in no time. Uncover the exclusive benefits of our tool by editing and filling out your PDF form. Bir Form 2305 – Fill Out and Use This PDF. Business . . Tax Registration Application, Instructions and Bond Forms (NOTE: For optimal functionality, save the form to your computer .o If not legally separated – BIR waiver form (even without the signature of the husband) and attach a letter or explanation. Please indicate the full name and Tax Identification number of the spouse in both the waiver form and Form 2305 o If husband is unemployed – indicate status of husband as unemployed in the BIR 2305 formbir form 2305 online registrationThe Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax .o If not legally separated – BIR waiver form (even without the signature of the husband) and attach a letter or explanation. Please indicate the full name and Tax Identification number of the spouse in both the waiver form and Form 2305 o If husband is unemployed – indicate status of husband as unemployed in the BIR 2305 formDownloadable Forms . BIR Forms. BIR Form No. 2305 – Certificate of Update of Exemption and of Employer’s amd Employee’s Information (pdf/656kb) BIR Form No. 1902 – Application for Registration (pdf/1.38mb); BIR Form No. 1905 – Application for Registration Update (pdf/112kb); Note: These BIR forms are using legal size paper .

To streamline this process, the Bureau of Internal Revenue (BIR) rolled out a new mandate for form 2305, or the Certificate of Update of Exemption and of Employer’s and Employee’s Information. Here are the official purposes of form 2305 and a similar form, form 1905. . This form is also used to update your registration information, to .

To be filled-up by BIR DLN: Fill in all applicable spaces. Mark all appropriate boxes with an “X”. 1 Type of Filer Employee (for update of "Exemption" and other employer's and employee's information) 2 Effective Date Self-employed (for update of "Exemption") Part I 3 TIN 4 RDO Code 5 Sex Male Female2302 Bir Form To be filled-up by BIR DLN: Fill in all applicable spaces. Mark all appropriate boxes with an “X”. 1 Type of Filer Employee (for update of "Exemption" and other employer's and employee's information) 2 Effective Date Self-employed (for update of "Exemption") Part I 3 TIN 4 RDO Code 5 Sex Male FemaleFile your application for registration with the BIR using the BIR Form 1901 at the Revenue District Office (RDO) having jurisdiction over your business address or home address. Aside from submitting supporting documents for filing the BIR Form 1901 , you’ll be required to pay an annual registration fee of Php 500, certification fee of Php 15 .The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR . BIR Form 1907 (Application for Permit to Use Cash Register machines/Point-of-Sale Machine) If you tend to use cash register machines in issuing receipts or invoices, you have to get this file. BIR Form 2305 (Certificate of Update Exemption and of Employer’s and Employee’s Information) Prior to the issuance of RMO No. 37-2019, employees who recently changed employers update their BIR registration records through their new employer by filing a Certificate of Update of Exemption and of Employer’s and Employee’s Information (BIR Form 2305). In BIR Form 2305, both the employee’s residential address and the .

The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR .The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR .

Those using option 1 and 2 are required to use the 2305 batch file validation module. Employer shall generate a monthly CSV file report and submit via email to [email protected] following the procedures in the Job Aids (Annex A or B) and Process Flows (Annex C or D).

bir form 2305 online registration|2302 Bir Form

PH0 · Philippine Government Forms

PH1 · How to Update your Marital Status with the BIR

PH2 · Bir form 2305: Fill out & sign online

PH3 · Bir Form 2305: Fill in & eSign

PH4 · BIR eAppointment System

PH5 · BIR Form No. 2305 Certificate of Update of Exemption and of

PH6 · BIR Form 2305

PH7 · BIR FORM NO. 2305 Certificate of Update of Exemption and

PH8 · BIR FORM NO. 2305 Certificate of Update of Exemption and

PH9 · BIR FORM NO. 2305 Certificate of Update of

PH10 · 2302 Bir Form